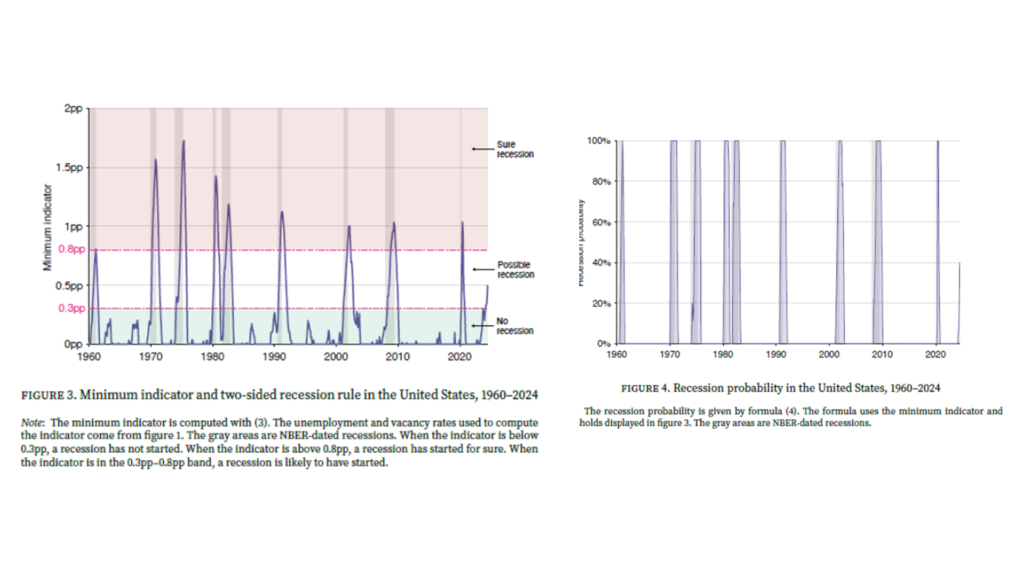

We create a new Sahm-type recession indicator that combines unemployment and vacancy data in order to provide an answer to this query. The indicator consists of two parts: the difference between the 3-month trailing average of the unemployment rate and its minimum over the previous 12 months,

which is the minimum of the Sahm indicator; and the difference between the 3-month trailing average of the vacancy rate and its maximum over the previous 12 months, which is an indicator constructed similarly with the vacancy rate. We then suggest a recession rule with two sides:

A recession may have begun when our indicator reaches 0.3 pp; it is certain to have begun when the indicator reaches 0.8 pp. The Sahm rule detects recessions 2.6 months after they begin, whereas this new rule detects them 1.4 months earlier on average. This new rule is activated earlier than the Sahm rule.

The Sahm rule falters before 1960, while the new rule has a better historical record, accurately identifying every recession since 1930. Our indicator is at 0.5pp using data from July 2024, meaning there is a 40% chance that the US economy is currently in a recession. Actually, it’s possible that the recession began in March 2024.

Images

I believe the writers use final updated data rather than real-time data. In light of the significant impact of population controls, particularly in recent years, it would be beneficial to determine whether the results held up well to the use of real-time data.

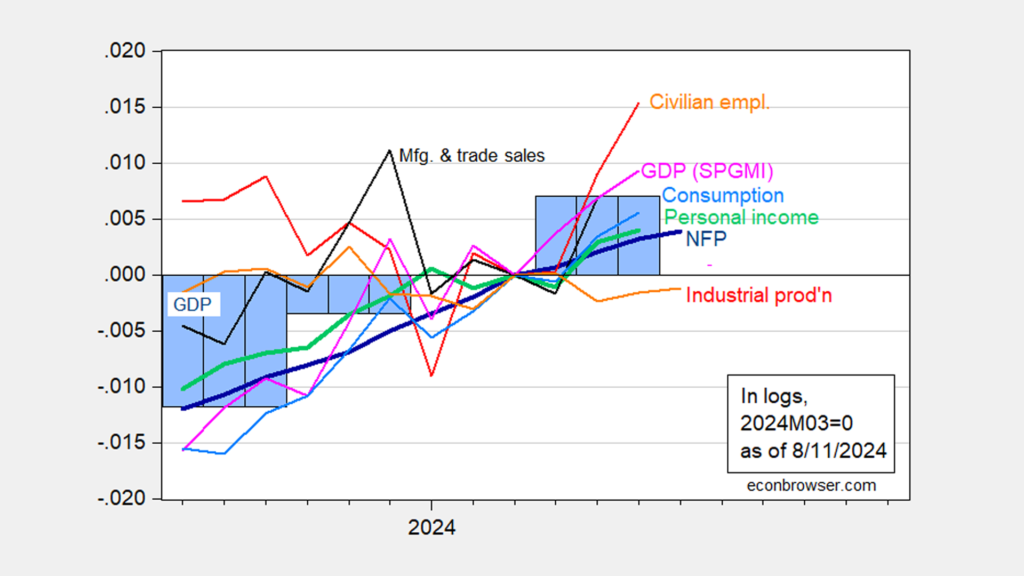

After normalizing NBER indices to the high of 2024M03, we obtain Figure 1:

Figure 1: Manufacturing and trade sales in Ch.2017$ (black), monthly GDP in Ch.2017$ (pink), GDP (blue bars), nonfarm payroll (NFP) employment from CES (bold blue), civilian employment (orange),

industrial production (red), and personal income excluding current transfers in Ch.2017$ (bold green). All log normalized to 2023M04=0. Sources: Federal Reserve, S&P Global Market Insights (formerly

Macroeconomic Advisers, IHS Market) (8/1/2024 release), BLS via FRED, BEA 2024Q2 advance report, and author’s calculations.

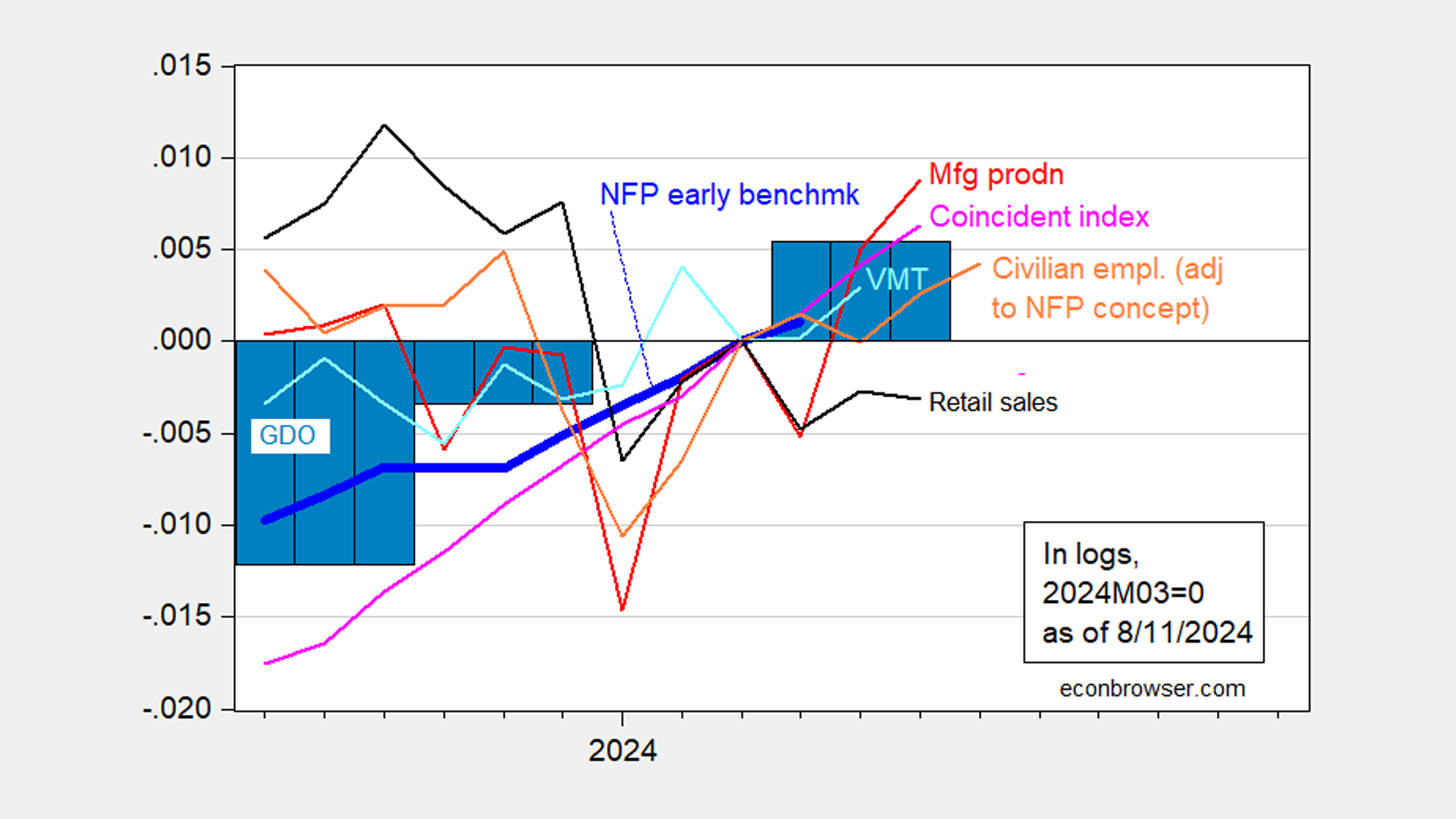

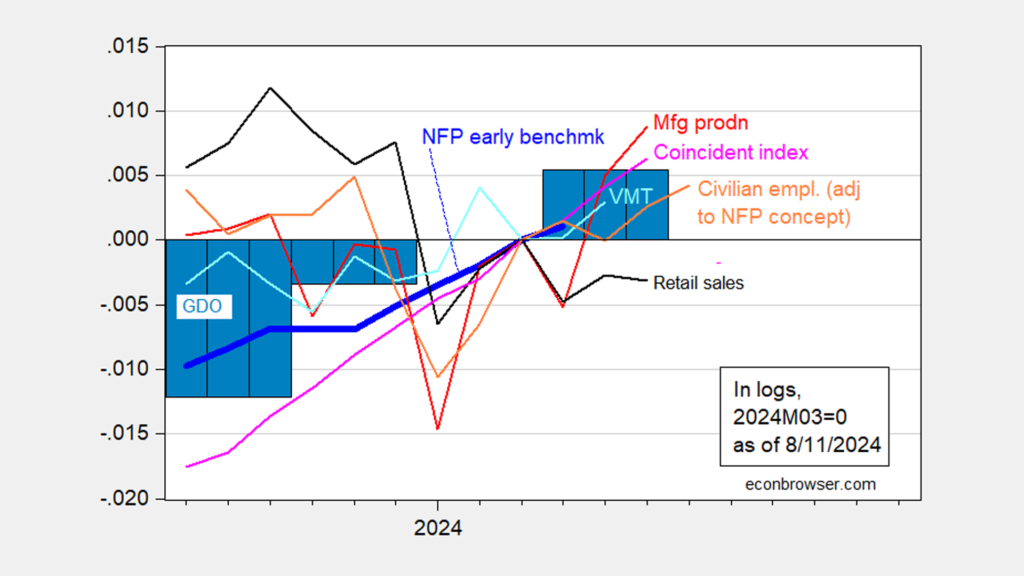

Additionally, substitute indicators:

Figure 2: Manufacturing production (red), retail sales (black), vehicle miles traveled (light blue), Coincident Index (light pink), GDO (blue bars), civilian employment adjusted to NFP concept (orange), and nonfarm payroll (NFP) employment (Philadelphia Fed early benchmark, bold blue).

All data are log normalized to 2023M04=0. GDI was utilized to estimate the GDO for 2024Q2 by applying GDP, lagged surplus, lagged differenced surplus, and 2021Q1–2024Q1 to anticipate the net operating surplus for 2024Q2.Source:

Author’s calculations and BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, Philadelphia Fed. While all of these series will undoubtedly be revised to varied degrees, GDP is the one that is most vulnerable, which is why NBER’s BCDC gives it the least weight.